Resolution company

Trusted

Professional

Claim Adviser

Resolution company

Trusted

Professional

Claim Adviser

Resolution company

Trusted

Professional

Claim Adviser

Resolution company

Trusted

Professional

Claim Adviser

Customer

Welcome to Claim Samadhaan

Trusted by

customers

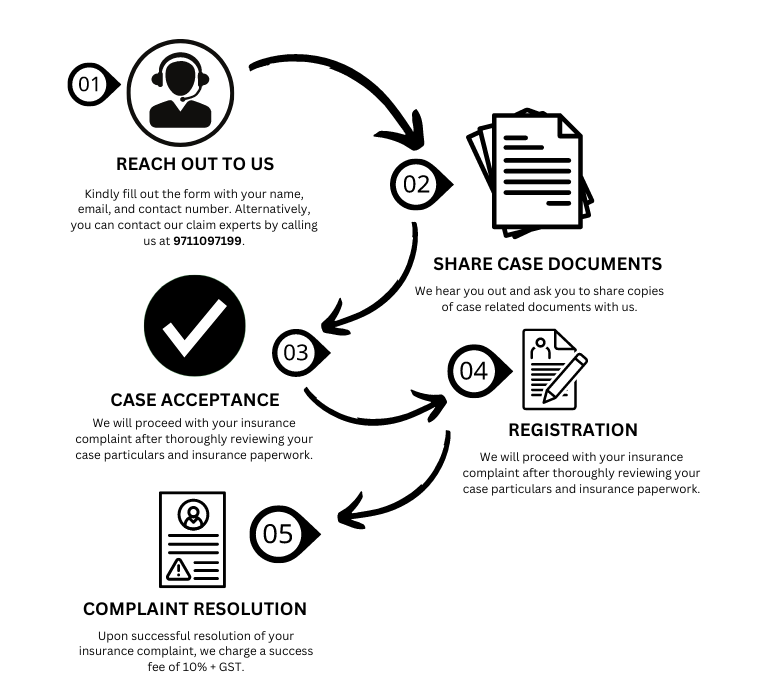

Our Hassle-Free Process

Reach out to us

Share case documents

Case Acceptance

Reach out to us

Share case documents

Case Acceptance

Providing all the services for you

Claim Rejection

Delay in Claim Process

Claim Short-Settled :

Mis-selling of Insurance:

service company

FAQs ?

What are some common examples of insurance mis-selling?

- Promising interest-free loan on a mortgage or insurance plan.

- The promise of free health insurance.

- Insurance sold as a Fixed deposit in a bank.

Why do insurance companies reject claims?

How do we handle your case?

Is there any fee to register with us?

A one-time registration fee of INR 500, including GST, is applicable for all

life, health, and general policies for you and your family members after case acceptance.

What is a success fee?

What they’re talking about company

180 satisfied & happy customers.

Rajesh Kumar

Priya Sharma

Dealing with insurance matters can be daunting, but this company made the entire process seamless. They listened attentively to my concerns and took prompt action to address them. I highly recommend their services to anyone facing insurance-related issues.

Amit sharma

After facing repeated delays and frustrations with my insurance provider, I decided to seek help from this organization. Their knowledgeable staff not only resolved my complaint efficiently but also provided valuable guidance throughout the ordeal. I am immensely grateful for their assistance

Vinod Kumar

I was pleasantly surprised by the level of professionalism exhibited by this company in handling my insurance complaint. From the initial consultation to the final resolution, their team displayed exceptional competence and dedication. I wouldn't hesitate to enlist their services again in the future.

Rohan Singh

Having struggled with an unresolved insurance issue for far too long, I was relieved to discover this agency. Their proactive approach and commitment to resolving complaints exceeded my expectations. Thanks to their efforts, I can now breathe a sigh of relief knowing that my insurance concerns have been effectively addressed.

Nisha Gupta

I had almost given up hope on ever getting my insurance claim sorted out until I contacted this company. Their team went above and beyond to ensure that my complaint was not only heard but resolved to my satisfaction. I'm truly impressed by their dedication and would highly recommend their services to anyone in need

Get Your Insurances Claim Resolved

I had been struggling with an insurance claim for months until I reached out to this remarkable team. Their dedication and expertise ensured that my complaint was swiftly resolved. I can't thank them enough for their professionalism and support.